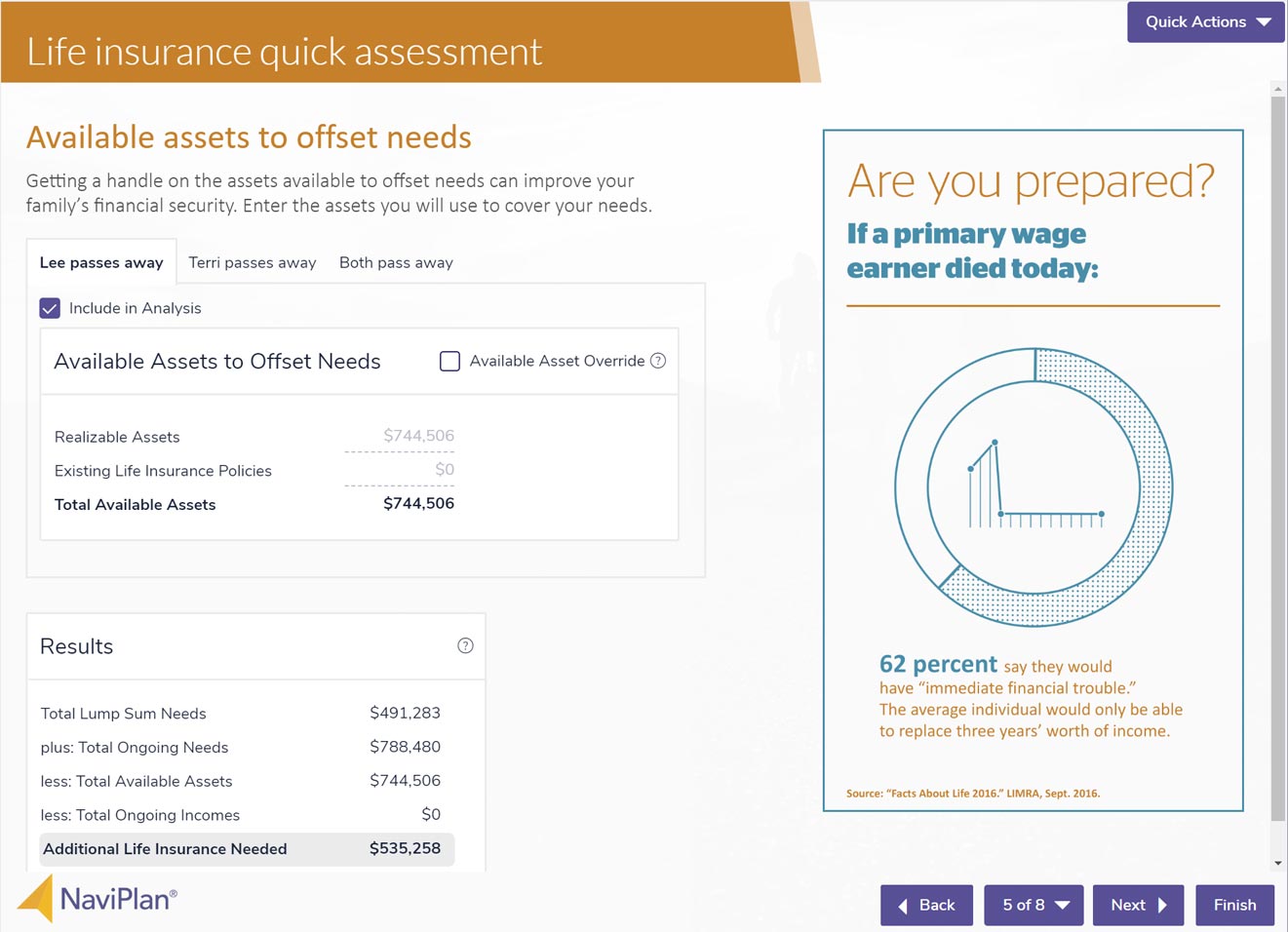

Life insurance

The life insurance quick assessment is designed to facilitate survivor need conversations quickly and efficiently.

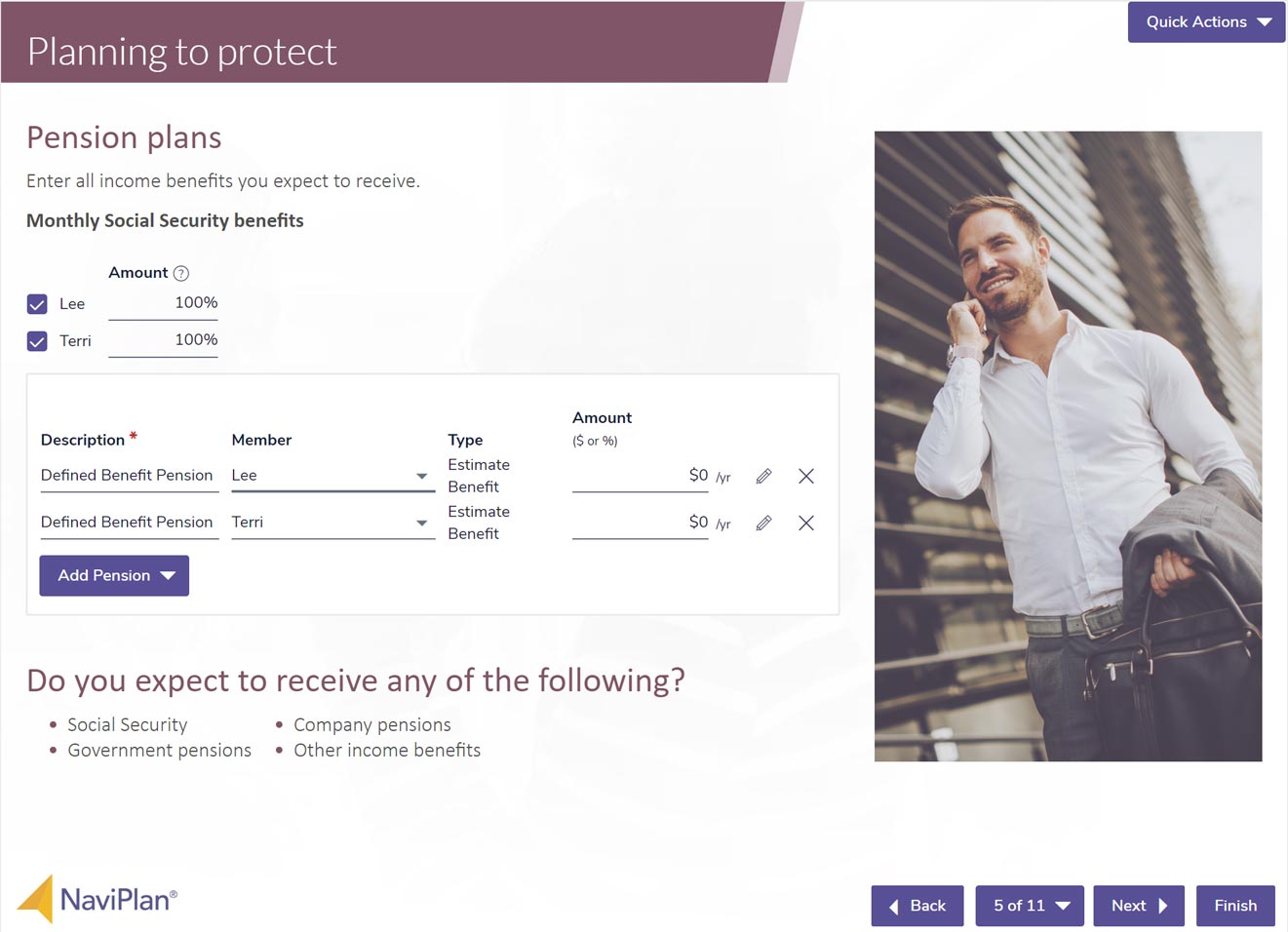

Disability insurance

Any insurance needs can be modeled within NaviPlan to assure clients in any scenario.

Long-term care insurance

Health care planning is not complete until you have run a long-term care gap coverage analysis. Help your clients feel secure in retirement.

Related resources for financial advisors

Serve the wide-ranging insurance needs of your client base with detailed modules and repeatable presentations available in NaviPlan.