Scale advice alongside needs

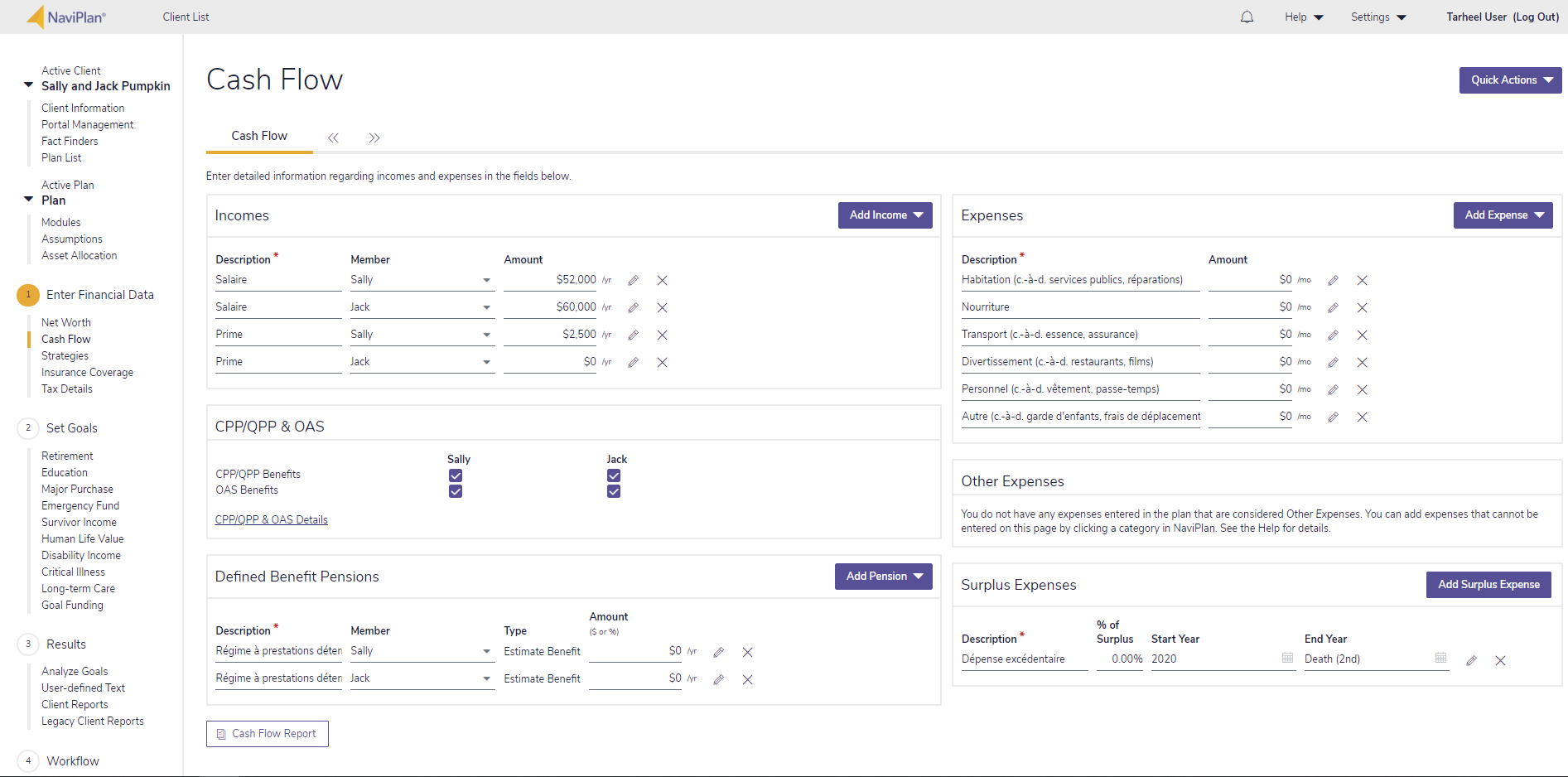

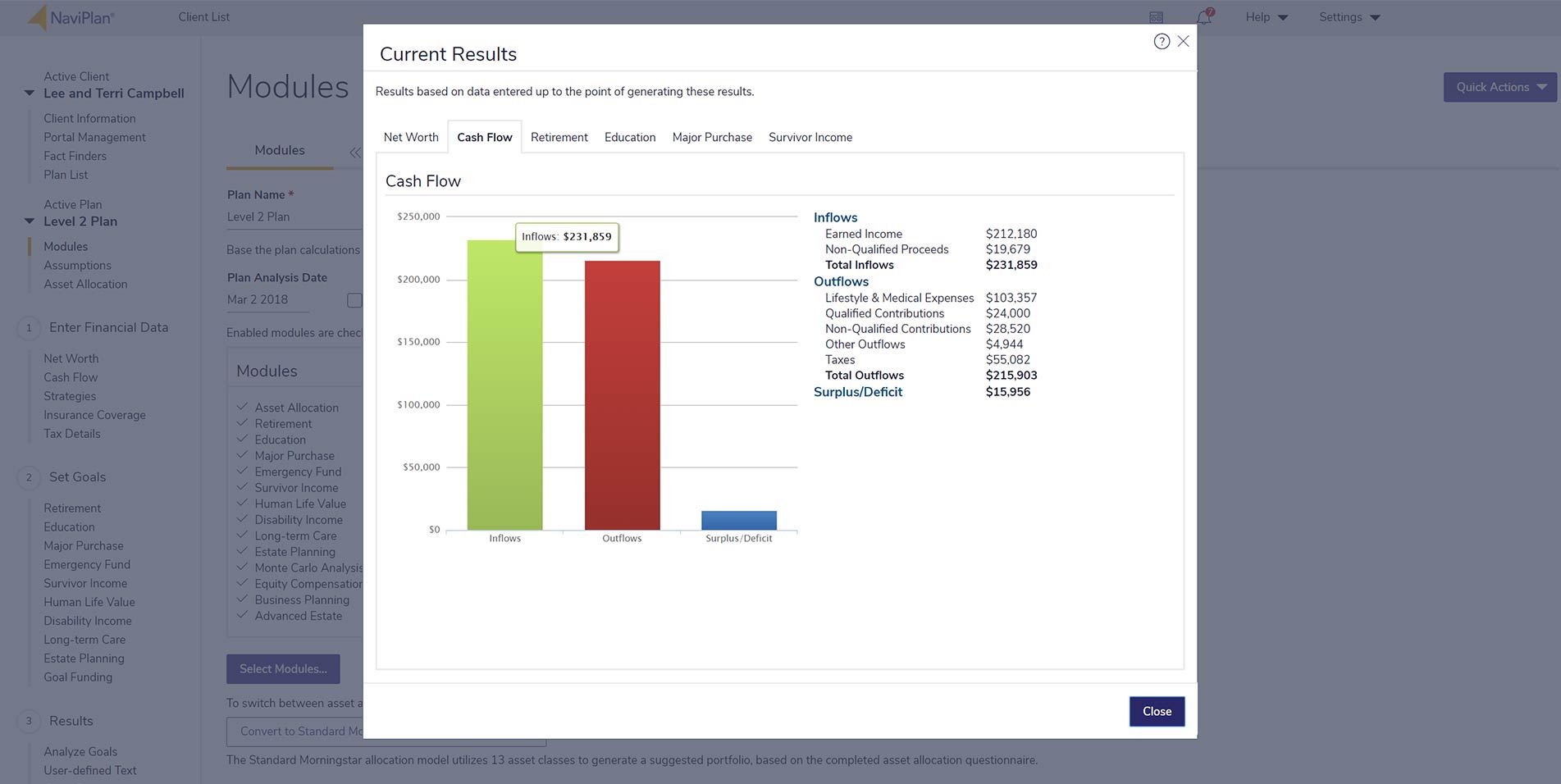

Client needs vary widely. Though some clients may only need a simple plan, there are few who would not benefit from cash flow analysis. Cash flow analysis enables advisors to deliver quality advice to every demographic, ranging from pre-retirement budgeting and debt paydown strategies all the way up to complex high-net-worth estate and tax analysis.

Increase client engagements

Whereas a goals-based financial plan can lead to infrequent meetings and potential for inaccuracy as a client’s situation evolves, cash flow planning encourages more regular client engagements. This not only leads to a far more accurate plan in the long-term but opens the door for additional selling opportunities with increased client conversations.